Property Market Updates 2025

At BMI Group, we believe in keeping our clients, investors, and stakeholders informed about the dynamic landscape of Gibraltar’s property market. Through our periodic updates, we share insights, trends, and forecasts based on extensive analysis and on-the-ground expertise, as shared by our Co-Founder and Managing Director, Louis Montegriffo. These updates provide clarity on the opportunities and challenges shaping the market, ensuring you have the information you need to make informed decisions.

In the latest Property Market Update from BMI Group, Managing Director Louis Montegriffo explains that little has changed since the previous update.

The market has generally remained subdued, particularly on sales. Current conditions can be described as a bear market which began in mid-2022, following a sharp rise in prices during the 2020 to 2022 period. That growth was driven by a continued growing economy, high demand, Gibraltar’s attractive tax regime and strong regulation, alongside limited supply.

Since then, prices have fallen by 15 to 25 percent. We view this, not as a collapse, but a realignment after increases that, in some cases, reached 100 percent. The market has likely reached the bottom of this cycle and we do not foresee further downturn. With the right pricing, transactions are happening. A point of fact, is that the high values per sqm reached in 2022 still remain, but only for frontline high value locations, this is a positive and reaffirms the resilience in the property sector.

Confidence as a Market Driver - The Agreement is here!

The most significant is the long-awaited post-Brexit agreement secured and announced subject to ratification by UK / EU parliaments. The absence of a clear path forward since 2016 has created prolonged uncertainty. Combined with inflation and rising interest rates, buyer confidence has taken a hit. However, Gibraltar’s economy has remained stable.

The biggest issue that affects any market, particularly the property market, is confidence. Global instability and financial volatility have added to hesitancy, but the slower pace has allowed the market to correct in a healthy way. The extreme pace of growth seen previously was unsustainable. With the announced Schengen Agreement in play, the future for the Jurisdiction has NEVER been better and the ability to provide all new potential applicants, business or client, a stable & secure home for the long term is simply superb and great for business and the property market.

Rental Market Signals Resilience

The rental market, by contrast, is showing strength. Historically, both sales and rental prices have fallen during downturns. This time, larger rental units have held their value. The rental market is very strong with continued demand for one- to four-bedroom homes.

Demand for rentals is a clear sign of ongoing interest in Gibraltar as a place to live and work. It is also a clean indicator of recovery in the sales market with renewed confidence translating into applicants choosing to purchase.

Is Now the Right Time to Buy?

Despite the recent correction, Montegriffo believes now could be a good time for buyers to enter the market. While values have dropped, the highest rates per square metre from 2022 are still being achieved in frontline properties. Other areas have adjusted, depending on location and quality.

“We are certainly optimistic moving forward,” he says. There is value to be found, particularly for first-time buyers and investors. Falling interest rates have also reopened the door for buy-to-let investors. With yields recovering to over 4 percent, and capital growth potential in the long term, the case for property investment is improving.

A Unique Long-Term Market

Gibraltar is not a low-cost market, especially for those entering from abroad. However, the territory remains attractive thanks to its strong employment sectors and appeal to high-net-worth individuals. From a Gibraltarian perspective, you are eligible to purchase in the affordable housing sector which is supported by Government and available to long-term residents.

During 2025 we expect the market to remain steady. The key variable is the agreement which will boost investor confidence and offer Gibraltar a more secure profile for long-term buyers.

We do not expect a sudden boom, however renewed activity in the medium term, especially from UK-based clients who have previously held back due to uncertainty will re-emerge.

.jpg)

Off-Plan Activity and Market Adaptation

BMI Group has been involved in many of Gibraltar’s off-plan developments since 2000. There are challenges facing new projects and many proposals are still tentative, floated to test interest rather than to launch immediately.

Among the few developments making progress are Midtown (final phase) and One Bayside. One Bayside took a different approach, undercutting the market to attract owner-occupiers. This pricing strategy helped the project secure sales and begin construction.

Europa Walks, is another ongoing development, offers a contrasting model. It is low density, features villas and townhouses, and is self-financed. Sales are more measured, with no requirement for pre-sales before construction.

Studio Oversupply and Developer Caution

Concern over the volume of studio units in current proposals. We question whether demand truly exists for so many small units and query whether developers need to re-evaluate their assumptions. This is something that we’ve been concerned about for a long time and with an agreement, it may be (as highlighted by a number of property people) that low-end props and studio market are affected, not just because of volume but rather who the end user may be with a free-flowing border in play.

Developers are holding back due to unrealistic price expectations or market uncertainty. As the agreement solidifies and confidence returns, more projects may move forward.

.jpg)

.jpg)

Confidence and Resilience

Throughout this latest property update, confidence remains a central theme. Very little to talk about, very little to see because of the uncertain bear market that we’ve been through, nevertheless, Gibraltar has shown consistent resilience.

The Rock seems to come out of hurdles very well. The territory’s small size, efficient management and strong economy have helped it avoid problems seen elsewhere, including property repossessions, which remain rare.

Long-Term Investors Still Active

High-value clients and family offices have continued to invest during this quieter period. BMI Group has handled several large transactions in recent months. These buyers are based in Gibraltar and are making decisions with a long-term view.

With an agreement now in play, the coming months could bring greater clarity and renewed activity. BMI Group will continue to provide updates as the market evolves.

If you’d like to listen to the entire videocast and learn more about the property market and BMI’s insight into all things property, you can contact Louis Montegriffo on louis@bmigroup.gi or visit https://www.bmigroup.gi/quarterly-updates for access to all market updates.

Experience | Knowledge

BMIGroup | Leading Estate Agents

As has been the case in so many of our previous updates, we place a great deal of importance on the impact of off-plan sales and the quality / profile of buyers; we do not tire in repeating simple logic, “owner occupiers” will always drive the sector - “let the market drive the market”.

This has been proven over the past 24 months where larger higher value properties have seen some incredible prices increases of up to 60/70%, driven by owner – occupiers and a lack of supply at this end.

A sensible 4 tier market

Our thoughts on a developing 4 tier market (low, mid, high, ultra-high) as described over the past 10 years are now firmly accepted. We believe that this more than serves as a positive indicator of the potential that the market continues to enjoy. The very fact that we are attracting a new ultrahigh segment is the clearest sign of confidence from a new emerging market, which we believe is here to stay – but which is dependent on a stable Gibraltar where we are able toat the very least offer a longer term forecast of what we can offer.

It is our firm view that we have a healthy property sector, split sensibly amongst four tiers. Few Finance Centres / Financial Services jurisdictions can boast such a cross section in the market, catering an array of property segments for various profiles - this in our view, once again shows the maturity of the market.

RATES PER SQM AND AVERAGE PRICES ACROSS THE BOARD ARE IDENTIFIED IN THE TABLE BELOW:

| Lower end market | £3,300/sqm - £4,500/sqm | £325,000 |

| Middle end market | £4,600/sqm - £6,000/sqm | £550,000 |

| High end market | £6,100/sqm - £8,000/sqm | £815,000 |

| Upper High end market | £8,100/sqm - £10,900/sqm | £1,200,000 |

Commercial Property in Gibraltar

With respect to current availability / stock, it is safe to say that there are options in various locations, but particularly so in older commercial developments. The offering is generally lower quality and in certain areas, compromised in terms of layout flexibility and sizes.

There is no question that an element of decanting from the older commercial properties into the newer and better designed office schemes has been the order of the day over the past 4 years. Worthy of note is the fact that letting rates/sqm have not been compromised at the higher end due to the decanting, in fact quite the opposite; applicants are prepared to pay high-end prices for high end specs. In our view this creates an opportunity for landlords with older (decanted) buildings, to upgrade and provide the market with improved offerings to market.

We take the view that new modern office options will only serve to improve the commercial offerings in the market and will generate new business steered by new expectation which once again serve to underpin the positive future for Gib Inc.

In light of the Covid pandemic and the advent of a greater volume of employees working from home, there is a case to be made in so far as less demand or a request for reduction in office space, particularly for the larger office users. We believe that this has not directly affected the high rates for Grade A offices being achieved, but there may be some circumstances where negotiations on rent reviews may now favour the tenant.

Having said all the above, we take a great deal of confidence from the fact that the economy continues to grow under difficult circumstances, with the recent news of the Agreement we are confident that the Commercial / Retail and F&B space will only grow.

CURRENT MARKET RATES:

| Europort | Europort | High value - Comm | £355 - £390/sqm pa |

| Leisure Island | Ocean Village | Complex | £360 - £440/sqm pa |

| Regal House | Queensway | Mid to high end | £250 - £300/sqm pa |

| Eurotowers | Europort | Good Amenities | £240 - £275/sqm pa |

| Leanse Place | Town (South) | Mid end | £240 - £275/sqm pa |

| Hadfield House | Town (Centre) | Mid end | £230 - £250/sqm pa |

| World Trade Centre | Marina Bay | High value - Comm | £430 - £480/sqm pa |

New Off-plan Developments and their impact

Currently and at the time of writing, Citi Homes, North Gorge, The Reserve, One Bayside and final phase of Midtown are the only major off-plan developments which are under construction, with a number of other projects such as Elysium Bayside and Monument Plaza yet to get off the ground.

We continue to see a great many re-sales at Eurocity (COMPLETED RECENTLY) particularly studios and one beds and continue to be of the view that prices within these types of properties may suffer, with available volumes on smaller units increasing by the day. E1 and Forbes, completed during the end of 2022 and whereas we have seen good movement in Forbes which comprises of a wider range of mixed units, E1 which is primarily studios and smaller one-bedroom units has seen a great many of the properties come back to market on re-sale and rentals which is seeing price expectations primarily on rentals affected – with expectations on yields being compromised.

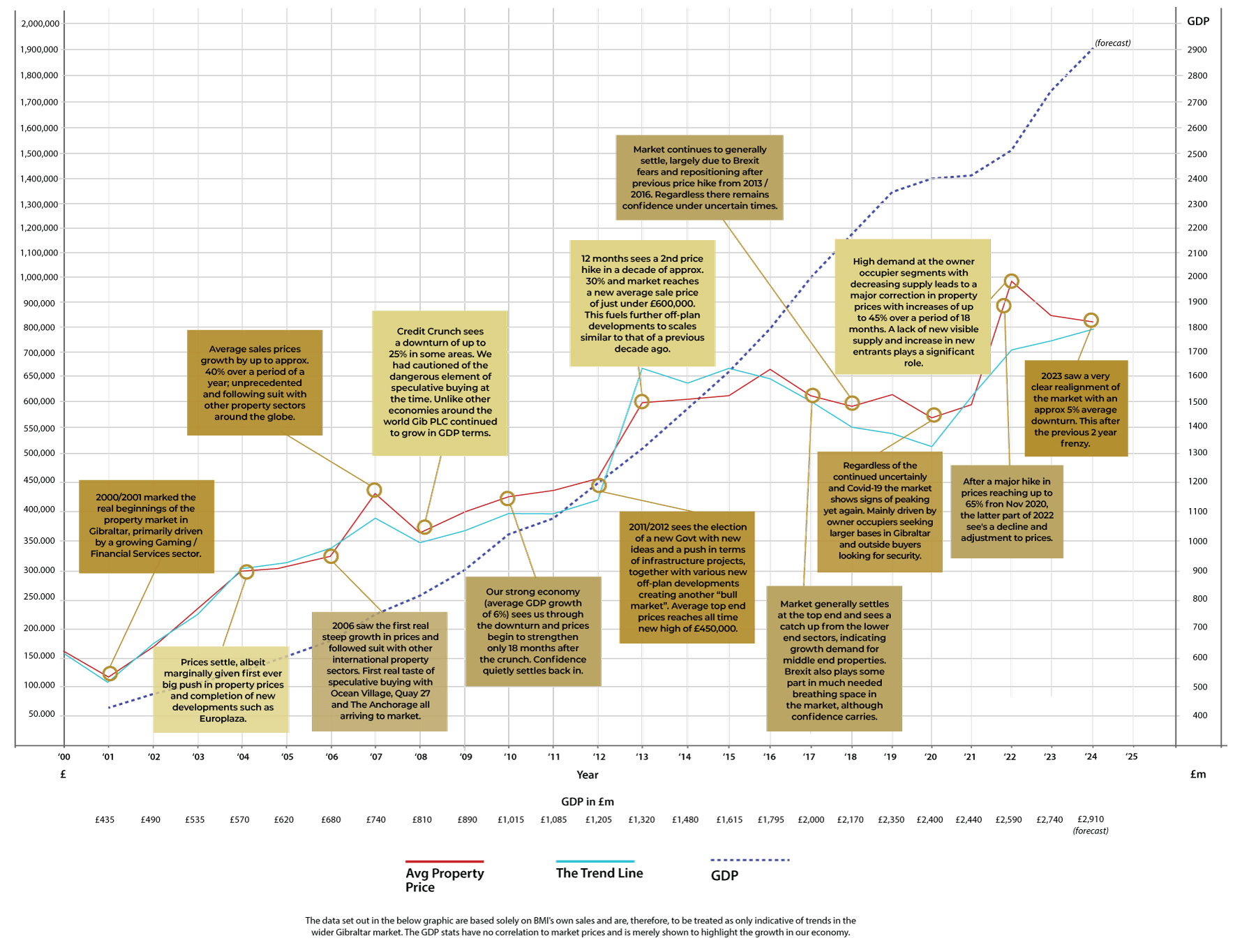

We have been fortunate, thanks to a thriving economy and new entrants across the board (commercial / retail / financial service / gaming / DLT / private clients) to find ourselves in a not uncommon situation of a serious lack in supply for larger higher value high-end properties, which has led to a hike in prices that had not been seen since 2007 and then again in 2013. See Property Price Graph above.

Fundamentally however, when it comes to sensible planning and knowing your market and your profile buyers, we have always maintained that a mix of owner occupiers, seasoned investors and a small measure of speculators is healthy, any overdose of the latter and you run the risk of exposing the market to an oversupply trend and in turn a property bubble. We saw this very situation in 2008 and in not such a large degree in 2014 and again 2017. See Property Price Graph above.

Thankfully, because of our well-protected economy, Gibraltar has (in the past 25 years) weathered oversupply storms and downturns better than most. In today’s climate where we are experiencing higher interest rates, an oversupply of smaller units, we do expect to see and are seeing a downturn in prices and yields in over-supplied segments. Nevertheless, we are seeing the downturn experienced now over 3 years plateau and firmly believe that with the Schengen Agreement in play now, we will see confidence return.

Gibraltar Economy / Property Sector

Property values as indicated have grown enormously in most sectors since November 2020. We have seen this rally slow down and adjust since May 2022.

Our take for the future has always been positive, we have remained cautious over the last few years, for the obvious reasons, but we firmly believe that with slowly decreasing interest rates, a buoyant rental market, continued growth in our economy and the recent news of the Agreement with EU, that the future is bright and there is a great deal to be optimistic about.

As stated new business for Gibraltar is present – long-term stability and security for the longer term is crucial and we are finally in a position to confidently present this to business and clients looking to relocate to the Rock.

We believe that the private client space will continue to feature highly as we see high-value clients looking for jurisdictions that can afford them a safe, proactive, low tax and regulated environment. Historically, where the world has been in crisis, jurisdictions like Gibraltar do well and invariably attract high-value clients looking for stability in safe well-regulated locations.

We believe that we have the potential to draw on this and continue with the journey that we have witnessed so far.

KEY RELATED ECONOMIC FACTORS:

- There continue to be NO bank repossessions.

- Unemployment remains below 1.5%.

- Finance Centre industry is growing from within with new sectors arriving on shore.

- Gibraltar now firmly remains the only highly regulated, low tax, English speaking centre in Europe.

PROPERTY FACTORS OF NOTE:

- Our lettings portfolio today stands at an average of 70 units, a substantial increase from last year and we feel this will increase further, primarily in the studio small one bed sector. This is already having an impact on yields which today have fallen to approx. 3.8%

- Our sales portfolio has substantially increased to an average of 180 units for sale. This relates only to real properties ready to move into and some re-sale off-plan units close to completion. We expect this to increase further, but we see price levels high in general terms with expectations from vendors hard to meet in some cases. Once again, too many smaller units at high prices will see this segment increase in size and will have an impact on prices. We are however comfortable and cautiously optimistic on owner occupier, high value properties where there is less supply. In particular frontline prime properties such as Ragged Staff and Kings Wharf phases 2 & 3 have held to the high rates achieved during 2022.

- High-value market sales have levelled off, but as expressed in previous updates, are very much here to stay, thereby underpinning the top end of the market and the confidence from applicants in this sector.

Selling or letting with BMI Group

Our team of 10 strong, include two dedicated property managers responsible for over 200 properties under management, a full-time account manager, two sales directors and other back office and administrative staff.

Our commercial department has recently been involved in two large transactions of mixed use and office developments amounting to approx. 4,000sqm of areas with a value of approx. £20,000,000.

In the past 18 months our sales team have acted and advised in the large majority of high value sales on the Rock including the high value residential sales at Admirals Place, The Sanctuary and over 80% of sales at the exclusive (phase 3) Buena Vista Park.

The BMI brand and our visibility on media and social media speak for itself, with page followings of near 4,000. We advertise daily and exposure to your property is guaranteed on our website which is updated daily.

Critical to our success is our ability to provide serious advice, and zero hype! Our market appraisals are supported by experience and knowledge of the market, and we provide real comparable sales supported by our four-tier scale on rates / sqm.

We are able to provide solid guidance and advice because we are firmly established as leaders in our field with a firm presence in the market over 25 years.

Speak to us first.

GIBRALTAR PROPERTY PRICES PER SQM

These stats are from currently available properties:

| Average | Highest | Lowest | |

|---|---|---|---|

| Current average rate per sqm | £7,239.08/sqm | £17,516.63/sqm | £3,357.07/sqm |

| Studio average rate per sqm | £8,422.00/sqm | £11,562.50/sqm | £6,000.00/sqm |

| 1 bedroom average rate per sqm | £7,644.68/sqm | £10,000.00/sqm | £5,825.15/sqm |

| 2 bedroom average rate per sqm | £6,736.09/sqm | £12,432.43/sqm | £4,148.15/sqm |

| 3 bedroom average rate per sqm | £6,969.44/sqm | £13,065.69/sqm | £4,000.00/sqm |

| 4 bedroom average rate per sqm | £8,226.28/sqm | £17,516.63/sqm | £4,996.88/sqm |

| 5+ bedroom average rate per sqm | £6,308.08/sqm | £10,565.00/sqm | £3,357.07/sqm |